TDS (Section 194Q) v/s TCS (Section 206C(1H)) Registration for company

With effect from 1st October 2020, the Government had introduced Section 206C(1H) i.e., a seller having turnover of more than Rs. 10 Crores in the preceding financial year is required to collect TCS from the buyers from whom receipts exceed Rs. 50 Lacs for sale of goods during the financial year.

This had already created a lot of ambiguities due to the reasons that it was made applicable during the mid of the year, taxability was governed on the collection and not on invoices, etc.

To overcome these ambiguities, they have introduced another ambiguity called Section 194Q i.e., a buyer having turnover of more than Rs. 10 Crores in the preceding financial year is required to deduct TDS of the sellers from whom invoices or payments exceeds Rs. 50 Lacs for purchase of goods during the financial year

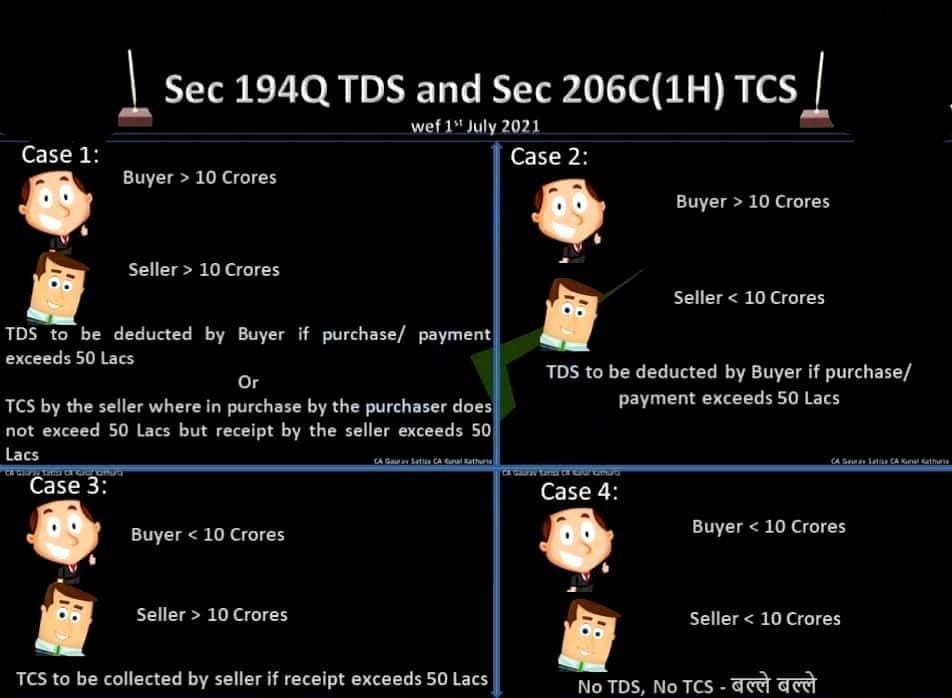

Now let us understand the same:

Applicability date:

01st July 2021.

Applicability with regards to Taxpayer:s

Section 194Q is applicable only if in the previous financial year (For present F Y 21-22, previous F Y will be 20-21), the total sales / gross receipts/turnover from the business excess Rs. 10 Crores. So, if turnover in the previous financial year is equal to or less than Rs. 10 Cr then this provision is not applicable. Registration for company

Kindly note that in both the sections i.e., Section 194Q and 206C(1H) the threshold limit concerning applicability per se taxpayer is the same. So, if any taxpayer’s turnover is below this limit, then he will be out of the ambit of both sections. And if the threshold limit is crossed then both the sections will be applicable.

Applicability with regards to Transaction:

Following are the exceptions wherein Section 194Q will not be applicable even if turnover in the previous financial year has crossed Rs. 10 Cr.

- Concerning the individual buyer with whom the purchase of goods doesn’t exceeds Rs. 50 Lacs in the current financial year.

- TDS is deductible under any other provisions of the Act. it means TDS will be deducted under that respective provision and not under this provision.

- Tax is collectible under Section 206C except Section 206C(1H).

Who will win in case of a fight between 194Q and 206C(1H)?

It has been specified under subsection 5(b) that if TDS u/s 194Q is applicable then TCS u/s 206C(1H) will not be applicable. So, TDS u/s 194Q will win the fight.

The process to be followed:

As an eligible buyer: – It will be your responsibility. So, deduct TDS u/s 194Q.

As an eligible seller: Take a declaration from your buyers that they will deduct TDS u/s 194Q (Format find below) and comply the same, else you need to charge TCS if buyers are not eligible or no such declaration is received or no such treatment is given by your buyers.

Threshold limit of purchase transactions:

As explained above, even if turnover has exceeded Rs. 10 Cr in the previous financial year, Section 194Q would not applicable for each purchase transaction in the current financial year.

This provision will be applicable only if purchase with a single buyer exceeds Rs. 50 Lacs in the current year and TDS will be applicable on the purchase amount over Rs. 50 Lacs.

Rate of TDS:

The rate of TDS would be 0.1%. Registration for company

When TDS is to be collected:

Payment or credit in books whichever is earlier i.e., like other normal TDS provisions.

When TDS is to be deposited with the Govt.

TDS is to be deposited up to the 7th of the Next month i.e., for April – 7th May etc., for March – 30th April

When TDS return is to be filed with the Govt.

TDS return is to be filed within one month succeeding the quarter. i.e., for April to June – 31st July and so on.

Difference between TDS (Section 194Q) v. TCS (Section 206C(1H) Registration for company

Particulars | TDS | TCS

|

Applicability on | Purchase / Payment whichever is earlier | Receipt |

Return filing period | 1 month after end of quarter (2 months after end of quarter for Q4) | 15 days after end of quarter |

Who will prevail if both applicable | TDS will prevail | TCS will NOT prevail |